Private equity has long been a cornerstone of the investment landscape, attracting capital from institutional and high-net-worth investors seeking substantial returns. Traditionally, private equity firms have relied on human expertise and intuition to make investment decisions. However, in recent years, the industry has experienced a significant transformation, with the integration of artificial intelligence (AI) becoming a game-changer. This article delves into the fascinating world of AI in private equity and explores how it is revolutionizing investment strategies.

Understanding the Role of AI in Private Equity

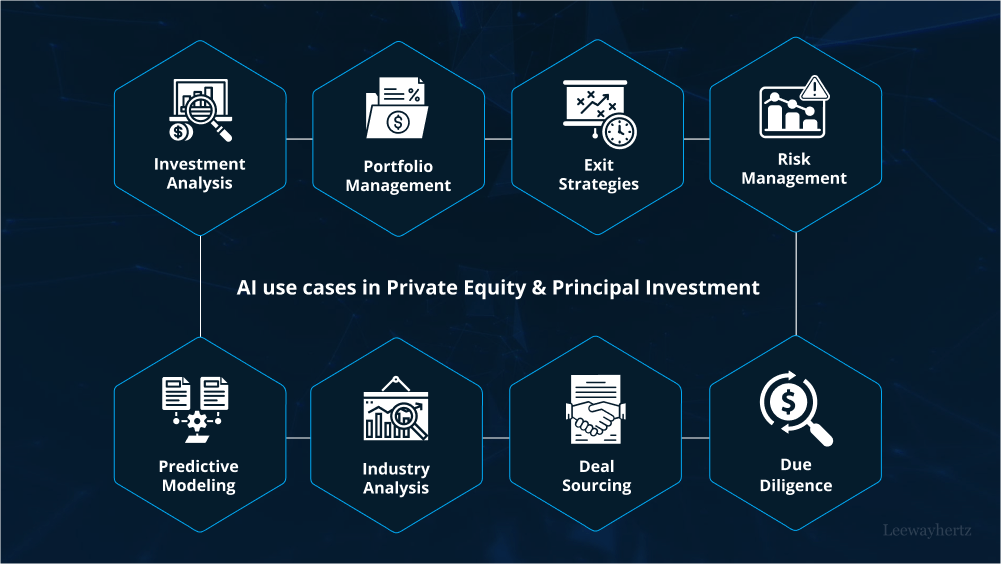

AI encompasses a wide range of technologies, including machine learning, natural language processing, and data analytics. In the context of private equity, these technologies are being leveraged to automate and enhance various aspects of the investment process, from deal sourcing to portfolio management.

- Deal Sourcing and Screening: AI-driven algorithms can quickly scan vast datasets of company information, financial reports, news articles, and market trends to identify potential investment opportunities. By analyzing historical data, AI can also help predict which companies are likely to outperform their peers, enabling private equity firms to make more informed decisions.

- Due Diligence: Conducting thorough due diligence is crucial in private equity. AI can streamline this process by automating the extraction and analysis of critical data points. It can identify potential red flags or areas of concern within a target company’s financials, contracts, and legal documents, thereby reducing the risk of overlooked issues.

- Portfolio Management: Once investments are made, AI continues to play a vital role in portfolio management. Predictive analytics can help identify areas of improvement within portfolio companies, allowing private equity firms to implement strategies that enhance operational efficiency and profitability.

- Risk Management: AI-powered models can assess and predict market risks, helping private equity firms make informed decisions about their investments. By continuously monitoring market conditions, AI can also provide real-time alerts about potential risks or opportunities, allowing for timely adjustments to investment strategies.

- Exit Strategy Optimization: AI can assist in optimizing the timing and method of exiting investments. It can analyze market conditions, company performance, and macroeconomic factors to determine the best exit strategy, whether it’s through an initial public offering (IPO), merger and acquisition (M&A), or other means.

Benefits of AI in Private Equity

The adoption of AI in private equity brings several advantages to investors and fund managers:

- Data-Driven Decision-Making: AI processes vast amounts of data at speeds impossible for humans to match. This enables private equity professionals to make data-driven decisions backed by comprehensive analyses.

- Efficiency and Cost Reduction: Automation of repetitive tasks, such as data collection and analysis, reduces the time and resources required for due diligence and portfolio management. This, in turn, lowers operational costs.

- Enhanced Risk Management: AI models can identify potential risks early on, allowing for proactive risk mitigation strategies. This minimizes the impact of adverse events on investment portfolios.

- Improved Investment Performance: AI’s ability to identify hidden patterns and trends can lead to better investment decisions, potentially resulting in higher returns for investors.

- Scalability: AI can handle a large number of investment opportunities simultaneously, providing private equity firms with the ability to scale their operations and explore a broader range of potential investments.

Challenges and Considerations

While AI offers numerous benefits, it is not without its challenges in the private equity space:

- Data Quality: AI relies heavily on data, and the quality of data used can significantly impact its effectiveness. Ensuring accurate and reliable data sources is essential for AI-driven decision-making.

- Privacy and Compliance: Private equity firms must navigate privacy regulations and compliance issues when handling sensitive data. AI solutions should be designed to adhere to these regulations.

- Human Expertise: AI is a tool to augment human decision-making, not replace it. Maintaining a balance between AI-driven insights and human expertise is crucial.

- Integration and Adoption: Integrating AI into existing workflows and cultures can be challenging. Firms must invest in training and change management to ensure successful adoption.

The Future of AI in Private Equity

The use of AI in private equity is not a passing trend; it’s a paradigm shift in the industry. As AI technology continues to advance, private equity firms that embrace it will gain a competitive edge in identifying lucrative investment opportunities, mitigating risks, and optimizing portfolio performance.

Additionally, AI is likely to democratize access to private equity investments. By automating many of the tasks traditionally performed by fund managers, AI-driven investment platforms can provide retail investors with opportunities to participate in private equity, previously reserved for institutional players and high-net-worth individuals.

In conclusion, AI in private equity represents a transformative force that is reshaping the industry. Its ability to analyze vast amounts of data, enhance decision-making processes, and improve investment performance makes it an invaluable tool for private equity professionals. While challenges remain, the potential benefits are too significant to ignore, making AI an essential component of the future of private equity.